CEE Standard: Using Credit

Credit cards can be a helpful tool for your students or a real problem that causes debt, which could affect their lives for years. Teach them how to use a credit card responsibly.

Congratulations on your first credit card! Now it’s time to educate yourself on how to manage this shiny piece of plastic so that you can build your credit responsibly over time.

Here are some tips to get you started:

Charge Only What You Can Afford

You’re hanging out at the mall with a few friends, and you spot an outfit that would be perfect for your best friend’s upcoming birthday bash. So you try it on, and as expected, it fits perfectly. Plus, the price is right.

But there’s only one problem: There isn’t enough money in your checking account to cover the purchase. To buy or not to buy? The smarter option would be to leave the clothing in the store until you have enough cash on hand or in the bank when your bill arrives.

Keep Balances Low

To piggyback off my last point, credit card debt is easy to get into, but tough to get out of once you’re in over your head. Those seemingly small purchases can quickly add up and leave you with a balance that’s much higher than you can comfortably afford to pay off each month. Keep in mind that the amounts owed on all your debts account for 30 percent of your credit score.

So the higher your outstanding balances, the lower your credit score will be.

Don’t Fall for the Minimum Payment Trap

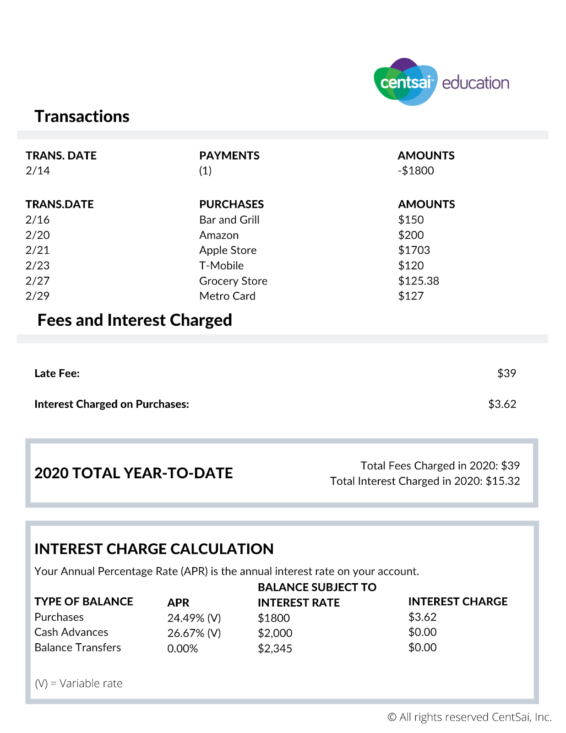

Are you thinking you can just pay the minimum payment each month and get out of debt in no time? Well, you may want to think again. This was by far the biggest mistake I made when managing my first credit card. But why? Well, only a small part is allocated to the outstanding balance. Everything else goes to interest and fees.

Always Pay on Time

If you don’t remember anything else from this list of tips, always remember to pay your bills on time, or your credit score will tank. Case in point: One of my credit cards had a $12.72 balance from a recurring account that I was unaware of. Long story short, the account was reported to the credit bureaus as delinquent on day 31 of it being past due, my score plummeted by almost 100 points, and I was hit with a $35 late fee. Even worse, it took several months for my score to rebound. (Side note: Late payments are reflected in your credit report and negatively impact your score for seven years.)

Review Your Statements

Remember that $12.72 balance from the last tip that destroyed my credit score? Well, I have to admit that it was a result of negligence on my part. I didn’t take the time to open the statement because I thought it had a $0 balance. I ended up paying for it big time: with approximately $47.72 and a mangled credit score, to be exact.

Understand Grace Periods

Due dates and grace periods are not created equal. The due date is the day by which you must pay at least the minimum payment to avoid a late fee and interest (APR). By contrast: “A grace period is the period between the end of a billing cycle and the date your payment is due,” according to the Consumer Financial Protection Bureau.

Read the Fine Print

You want to understand exactly what you’re getting into and the accompanying fee. A few things to be on the lookout for:

- Over-the-Limit Fee: A fee may apply if you swipe more than your card permits.

- Annual Fee: Some credit card issuers charge you a fee to be an account holder.

- Cash Advance Fee: Avoid ATMs at all costs, or you’ll pay a hefty fee to borrow — and in many instances, a higher APR. Plus, a grace period may not apply.

- Late Payment Fee

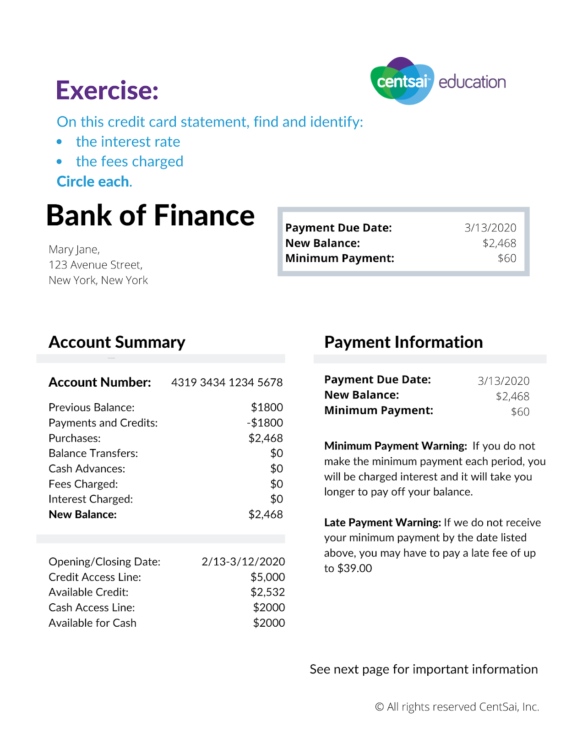

Exercise:

Monitor Your Credit Report

The best way to responsibly rebuild your credit over time is to make timely payments, keep the balances low, refrain from opening too many accounts at once, and most importantly, monitor your credit profile to ensure the accuracy of the contents of your FICO credit report.

You can retrieve a free copy of your credit report from each of the credit bureaus once every year at annualcreditreport.com. You can also sign up for free credit monitoring services, such as Credit Sesame and Credit Karma, which provide instant alerts anytime that activity takes place in your credit file.

Bonus Tip

Do not get a second card until you’re out of college and gainfully employed!

The Bottom Line

Credit card debt is super easy to get into, if you use your card(s) irresponsibly. So be proactive about responsibly managing your card from your first swipe to the day if and when you decide to add others to your arsenal.

- How does a credit card work?

- What are the advantages and disadvantages of paying the minimum payment each month?

- What is the difference between a debit card and a credit card?

- What is a credit score?

- Where can you get a copy of your credit report?